The FEIE Standard Deduction: How it works for digital nomads

Wiki Article

Understanding the Foreign Earned Income Exemption and Its Influence On Your Conventional Deduction

The Foreign Earned Revenue Exclusion (FEIE) offers significant benefits for migrants, enabling them to omit a part of their foreign-earned income from united state taxation. Nonetheless, asserting the FEIE can make complex one's tax obligation scenario, especially concerning the common deduction. Comprehending this communication is important for individuals living abroad. As expatriates navigate these complexities, they should think about exactly how their selections impact their total tax liability. What approaches can they use to maximize their financial results?What Is the Foreign Earned Revenue Exemption (FEIE)?

The Foreign Earned Revenue Exclusion (FEIE) acts as an important tax obligation benefit for U.S. residents and resident aliens functioning abroad. This provision enables eligible people to exclude a substantial part of their foreign-earned earnings from united state taxes, effectively decreasing their total tax concern. The FEIE aims to minimize the financial stress on migrants and urges Americans to go after employment possibilities in international markets. The exclusion relates to salaries, wages, and expert fees earned while living in a foreign country. The optimal exclusion amount is readjusted yearly for inflation, making sure that it stays relevant to current financial problems. By utilizing the FEIE, expatriates can preserve more of their earnings, fostering monetary security while living overseas. Overall, the FEIE plays a crucial role fit the monetary landscape for Americans abroad, helping with a smoother change to worldwide workplace and promoting economic engagement on a global scale.Qualification Needs for the FEIE

Qualification for the Foreign Earned Income Exemption (FEIE) rests upon conference details requirements set by the Internal Earnings Solution (INTERNAL REVENUE SERVICE) Mostly, individuals should be U.S. people or resident aliens who make income while living in a foreign nation. To certify, they need to satisfy one of two primary tests: the Physical Presence Test or the Bona Fide Home Examination.The Physical Presence Test calls for individuals to be physically present in a foreign nation for at the very least 330 full days within a 12-month period - FEIE Standard Deduction. On the other hand, the Bona Fide House Test demands that people establish residency in a foreign nation for an undisturbed duration that consists of a whole tax obligation year

In addition, the revenue needs to be originated from individual solutions executed in the foreign country. Fulfilling these demands permits taxpayers to omit a considerable portion of their foreign-earned earnings from united state tax, thus minimizing their overall tax obligation responsibility.

How to Claim the FEIE

:max_bytes(150000):strip_icc()/standarddeduction-resized-8f2ac3f88bca4ef099d637cb80f79e29.jpg)

To begin the procedure, individuals need to collect papers that confirm their international profits, such as pay stubs, income tax return from international nations, and any kind of relevant employment contracts. It is essential to assure all earnings declared under the FEIE is made from foreign sources and fulfills the needed limits.

In addition, taxpayers need to consider filing target dates and any possible expansions. Asserting the FEIE appropriately not just aids in minimizing tax liability yet also ensures compliance with IRS laws. Proper paperwork and adherence to standards are crucial for a successful insurance claim of the Foreign Earned Earnings Exemption.

The Communication Between FEIE and Common Reduction

The communication in between the Foreign Earned Earnings Exclusion (FEIE) and the typical reduction is a vital element of tax preparation for expatriates. Recognizing the standard concepts of FEIE, along with the limitations of the typical reduction, can significantly affect tax filing methods. This area will discover these elements and their ramifications for taxpayers living abroad.FEIE Basics Discussed

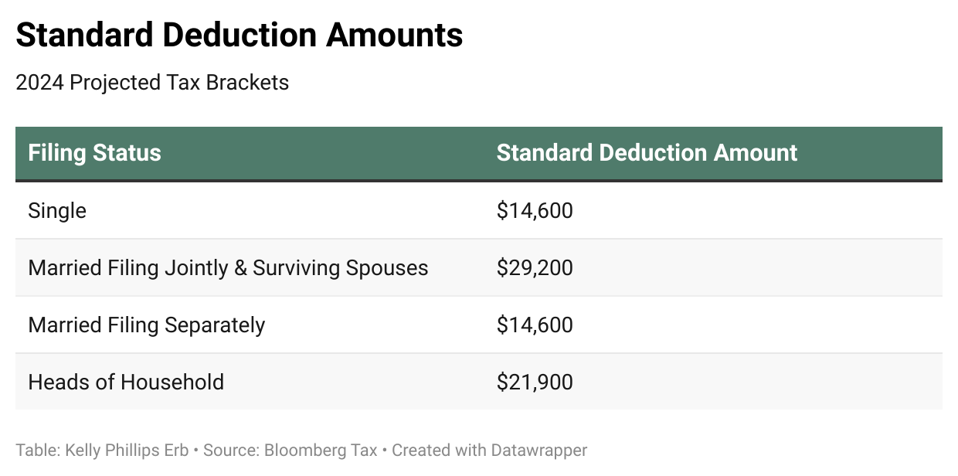

While many migrants look for to decrease their tax obligation problem, comprehending the interaction between the Foreign Earned Income Exclusion (FEIE) and the standard reduction is visit our website important. The FEIE allows U.S. citizens and resident aliens living abroad to leave out a particular amount of international earned earnings from U.S. tax. This exemption can significantly reduce gross income, potentially influencing eligibility for various other deductions, such as the typical deduction. Extremely, people that declare the FEIE can not also take the typical deduction against the excluded revenue. Consequently, expatriates should very carefully evaluate their complete revenue and deductions to maximize their tax obligation circumstance. Awareness of these interactions can cause even more educated monetary choices and far useful reference better tax approaches for expatriates guiding via their unique conditions.Criterion Deduction Limitations

Comprehending the limitations of the common deduction in connection with the Foreign Earned Revenue Exclusion (FEIE) is vital for migrants steering their tax obligations. While the FEIE allows qualifying people to exclude a particular amount of foreign-earned earnings from U.S. taxes, it can influence the conventional reduction they are qualified to case. Especially, taxpayers who assert the FEIE can not additionally assert the standard deduction on that excluded income. Additionally, if an expatriate's total revenue falls below the conventional deduction threshold, they might not gain from it at all. This interaction necessitates careful planning to maximize tax advantages, as underutilizing the common reduction can result in higher taxable earnings and enhanced tax responsibility. Recognizing these constraints is important for reliable tax method.Tax Declaring Effects

Maneuvering the tax obligation declaring ramifications of the Foreign Earned Income Exemption (FEIE) calls for mindful consideration of just how it connects with the basic reduction. Taxpayers using the FEIE can exclude a considerable part of their foreign-earned revenue, but this exemption influences their eligibility for the standard deduction. Specifically, if an individual insurance claims the FEIE, they can not additionally assert the conventional deduction for that revenue. This can cause a reduced general tax obligation obligation yet may make complex the declaring process. Additionally, taxpayers must ensure compliance with internal revenue service demands when filing Form 2555 for the FEIE. Understanding these interactions is crucial for enhancing tax obligation advantages while preventing prospective challenges in the filing process. Cautious planning can make best use of advantages and lessen liabilities.Prospective Tax Ramifications of Utilizing the FEIE

The Foreign Earned Income Exemption (FEIE) uses substantial tax obligation advantages for U.S. people functioning abroad, however it likewise features possible effects that necessitate mindful consideration. One major consequence is the effect on eligibility for sure tax credit scores and deductions. By electing to make use of the FEIE, taxpayers might accidentally minimize their adjusted gross earnings, which can restrict accessibility to credit scores like the Earned Income Tax Credit or minimize the amount of basic deduction readily available.

Furthermore, people that use the FEIE might encounter difficulties when going back to the U.S. tax obligation system, specifically concerning the tax of future revenue. The exemption applies only to made earnings, meaning other earnings types, such as rewards or interest, stay taxable. This distinction demands thorough record-keeping to assure compliance. The FEIE might affect state tax obligation responsibilities, as some states do not acknowledge the exemption and might strain all income earned by their residents, no matter of where it is earned.

Tips for Maximizing Your Tax Advantages While Abroad

While functioning abroad can be enriching, it also provides special possibilities to enhance tax obligation advantages. To take full advantage of these advantages, individuals must initially identify their webpage qualification for the Foreign Earned Earnings Exclusion (FEIE) and take into consideration the physical visibility examination or the bona fide house test. Maintaining detailed records of all revenue earned and costs incurred while overseas is important. This documents sustains claims for deductions and credit reports.In addition, comprehending the tax obligation treaties between the USA and the host nation can assist avoid double taxation. Individuals need to also explore payments to tax-advantaged accounts, such as Individual retirement accounts, which may offer more reductions.

Last but not least, speaking with a tax expert concentrating on expatriate tax obligation law can supply tailored strategies and warranty conformity with both U.S. and foreign tax obligation responsibilities. By taking these actions, expatriates can properly boost their monetary circumstance while living abroad.

Often Asked Questions

Can I Use FEIE if I Benefit an International Federal government?

Yes, a person can utilize the Foreign Earned Revenue Exclusion (FEIE) while benefiting an international federal government, provided they meet the requisite problems laid out by the IRS, including the physical presence or bona fide residence examinations.

Does FEIE Use to Self-Employment Earnings?

The Foreign Earned Earnings Exemption (FEIE) does put on self-employment revenue, gave the private satisfies the needed requirements. Eligible independent people can exclude qualifying earnings earned while residing in a foreign nation from taxes.What happens if My International Revenue Surpasses the FEIE Limit?

The excess amount might be subject to United state taxes if international earnings surpasses the FEIE limitation. Taxpayers must report and pay taxes on the earnings above the exemption limit while still gaining from the exemption.Can I Assert the FEIE and Itemize Deductions?

Yes, individuals can claim the Foreign Earned Income Exclusion (FEIE) while likewise itemizing deductions. Nevertheless, they must realize that asserting the FEIE might influence the accessibility of particular itemized deductions on their income tax return.Exactly How Does FEIE Impact My State Tax Obligation Responsibilities?

The Foreign Earned Revenue Exemption can decrease state tax obligation commitments, as several states comply with federal guidelines. Nonetheless, private state rules vary, so it's essential to consult state tax obligation regulations for particular ramifications on tax responsibilities.The Foreign Earned Income Exemption (FEIE) supplies significant advantages for migrants, enabling them to leave out a portion of their foreign-earned revenue from United state tax. While lots of migrants look for to minimize their tax obligation problem, comprehending the communication between the Foreign Earned Revenue Exemption (FEIE) and the common deduction is necessary. Comprehending the constraints of the standard deduction in relation to the Foreign Earned Income Exclusion (FEIE) is essential for expatriates steering their tax obligation responsibilities. The exclusion applies only to gained income, indicating other income kinds, such as returns or rate of interest, continue to be taxable. The Foreign Earned Income Exemption (FEIE) does apply to self-employment earnings, gave the individual meets the essential needs.

Report this wiki page